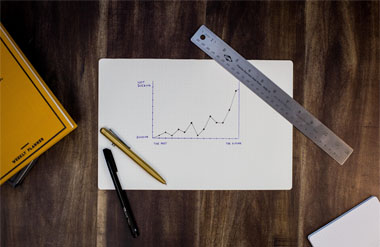

73% Chance of rate increase

The Federal Reserve board is meeting is coming up May 3-4 and again June 14-15 this year. According to traders, there is a 73% chance that the May meeting will result in ½ percent increase and a 63% chance the June meeting will result in ½ percent increase in the Fed long term interest rate.…

Read more

Sellers: Your window is closing

According to CNBC, the average contract interest rate for a 30 year fixed rate mortgage and conforming loan balance ($647,200 or less) increased to 4.9% from 4.8% for loans with a 20% down payment. I am already hearing about 6% rates from my mortgage broker friends. As you would expect, this impacted mortgage applications, which…

Read more

Five tips to go green at home

In honor of Earth Day Friday, April 22nd, I wanted to share five practical tips that can make a meaningful impact on your environmental footprint. My family and I take many small steps to reduce our environmental impact as opposed to focusing on one big thing. There are hundreds and hundreds of little things that…

Read more

April Market Update

Interest rates are rising. Most experts believe, and I agree, that higher interest rates will cool today’s torrid housing market. Buyers will have less purchasing power thereby reducing demand. This is balanced against more than a decade of building fewer homes than was required to meet demand, so inventory remains tight. A new report out…

Read more

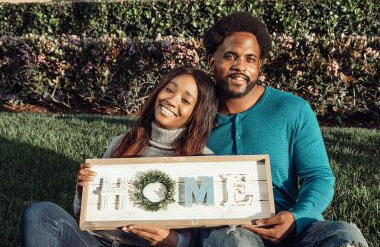

Your offer has been accepted. What next?

Congratulations! Your offer on the home of your dreams has been accepted! Let’s explore what happens next. As the buyer, once you have reached agreement on the purchase of a new home you and your team will be responsible for much of the activity. Either the listing agent or your agent will open an escrow…

Read more

How Much Earnest Money?

Earnest money is the deposit buyers make to secure an offer on a property. There is no standard amount of earnest money a home buyer is required to put down, the amount of the deposit and conditions placed on it are meaningful. The amount is entirely the buyer’s decision. From a seller’s perspective, earnest money…

Read more

Financially Preparing to Buy a Home

Most people can’t just rock up and buy a new home without some advance preparation. The purpose of this post is to provide a bit of a road map and some priorities for that preparation. Lenders are going to take a hard look at your history and finances when considering how much to loan you.…

Read more

How Much Home Can You Afford?

A lot more than you might imagine goes into determining how much home you can afford. The purpose of this post is to explore some of those inputs. In order to begin to calculate what you can afford, you need to understand your household income, monthly debts, and the amount you have available as a…

Read more