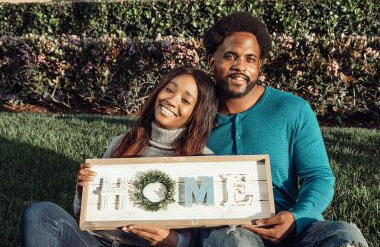

Your offer has been accepted. What next?

Congratulations! Your offer on the home of your dreams has been accepted! Let’s explore what happens next.

As the buyer, once you have reached agreement on the purchase of a new home you and your team will be responsible for much of the activity. Either the listing agent or your agent will open an escrow account. The escrow and title company is most often dictated by the seller’s side at listing time.

If you included an inspection contingency, you should contact a qualified home inspector to conduct a walkthrough inside and out. If needed, pest inspections are handled separately. A good home inspector will recommend a pest inspection if they see evidence that it’s needed. If any issues are identified, you will have an opportunity to require the sellers to address the issues or renegotiate the purchase offer. If you don’t already know a home inspector, contact me and I can refer one.

Hopefully you have already been pre-approved for a mortgage. If you have not been, now is the time to complete your mortgage application. I work with a number of lenders and I’m happy to refer you to someone if it’s helpful. The next step will be for the lender to send out an appraiser. The goal is for the appraiser to value the home for at least as much as your agreed purchase price. If the appraisal is low, you may be able to renegotiate the price with the seller or you may need to come up with additional cash to make up the difference. If you included a financing contingency, you will likely be able to cancel the purchase at no penalty based on the low appraisal if necessary.

Title insurance is likely to be provided by the title company identified in the transaction. However, you can use a third-party title company for title insurance. For simplicity most do not.

Once your loan is approved, you are almost at the finish line. The escrow or title agent should send you a formal notice of the closing date and time. This will include a breakdown of costs and what you need to bring to the closing meeting.

The final step for you is to sign the papers. The documents are likely to be 100 pages or more. Make sure to verify the interest rate and the type of loan are what you expect. An attorney can help you interpret finer points of the documents if you are concerned.

Once all parties have signed, the loan will be funded and the escrow company will file necessary documents with the county.

Then, the hard work of moving and unpacking can begin!

Contact me if I can help you navigate the home buying (or selling) process.